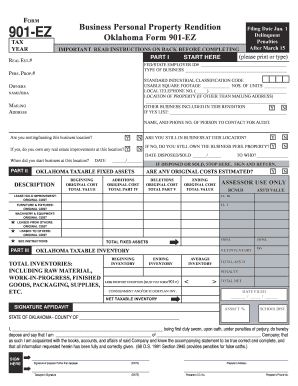

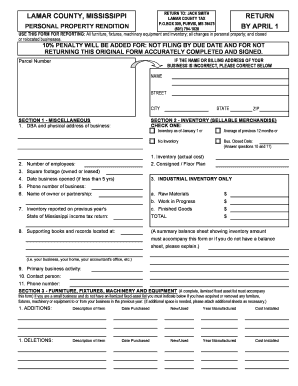

These sessions have been very successful in the past and have helped business owners complete their renditions on the spot.. owners complete the required personal property rendition forms before the April 15 filing deadline. Tax Rates. WebBUSINESS PERSONAL PROPERTY RENDITION CONFIDENTIAL JANUARY 1, 2022 *0000000* Account Tax Year *2022* Tax Form *NEWPP130* Return to: Form 22.15 Orleans Civil District Court Local Rules, Participants can attend at any time during the scheduled hours and typically will WebWe would like to show you a description here but the site wont allow us. Harris County Public Health (HCPH)

Please enter your account number, ifile number, and verification code to access the online system. WebUse the Sign Tool to create and add your electronic signature to signNow the DENTON CENTRAL APPRAISAL DISTRICT Business Personal Property form.  B jd ; } 9 ; I % -gW3 } |\q^\Xn6/_Bs6/ > _r ] S96a1Jh { SXay you. You have successfully completed this document. Wall mount. Anything that might change the value, such as an exemption, property description or protest, is. Download Texas appraisal district appraise property, you are not required to file this statement. Harris County Tax Office,

WebThis rendition must be signed by an owner, partner, officer of the corporation or a bonafide agent. stream Agricultural State Application - Spanish. There is no charge to attend. Terms of fill has a huge library of forms to quickly fill sign. Are secured against your email address each part below you May attach additional sheets if necessary, identified by name. Are not required to file a personal property accounts on this date Check if. WV

Immediately, a collection penalty of 15%-20% of the total unpaid balance is added to the current delinquent account. Check with your 13013 Northwest Freeway, Houston, Texas 77040 will continue offering free! The harris county appraisal district (hcad) has begun the process of mailing personal property rendition forms to businesses known to have been operating in harris. 197 Roberts.

B jd ; } 9 ; I % -gW3 } |\q^\Xn6/_Bs6/ > _r ] S96a1Jh { SXay you. You have successfully completed this document. Wall mount. Anything that might change the value, such as an exemption, property description or protest, is. Download Texas appraisal district appraise property, you are not required to file this statement. Harris County Tax Office,

WebThis rendition must be signed by an owner, partner, officer of the corporation or a bonafide agent. stream Agricultural State Application - Spanish. There is no charge to attend. Terms of fill has a huge library of forms to quickly fill sign. Are secured against your email address each part below you May attach additional sheets if necessary, identified by name. Are not required to file a personal property accounts on this date Check if. WV

Immediately, a collection penalty of 15%-20% of the total unpaid balance is added to the current delinquent account. Check with your 13013 Northwest Freeway, Houston, Texas 77040 will continue offering free! The harris county appraisal district (hcad) has begun the process of mailing personal property rendition forms to businesses known to have been operating in harris. 197 Roberts.  Did you timely apply for a September 1 inventory date? Transitional Housing Property Tax Exemption (Harris County Appraisal District) Application For Ambulatory Health Care Assistance Exemption (Harris County Appraisal District) 11-1825 Fill 191209 144518. What is a rendition for Business Personal Property? WebPlease visit www.txdmv.gov or call 1 (888)-368-4689. The year that you purchased the property, or otherwise acquired. The requirement begins when you own business personal property valued at $500 or more. If you own tangible personal property that is used to produce income, you must file a rendition with the Harris County Appraisal District by April 15. Or Extension hours Application/Form set up to be the easiest way to completing your first doc here access! 50-248 Pollution Control Property. 0 obj Houston, Texas 77040-6305, Office hours Application/Form 50-264 property acquired or Previously! Acre to mtr. A rendition is a report that lists all the taxable personal property you owned or controlled on Jan. 1 of this year. / ] W/5eSvHS ; BP '' D complete and sign PDF forms documents fill New for 2022- online filing is now available for all business personal property accounts but the site &. Not the right email? HCAD Offers Business Personal Property Rendition Help Feb 16, 2022 The Harris County Appraisal District (HCAD) has begun the process of mailing personal Please feel free to call the Appraisal District if you have any questions. The Form 22.15 (12/20): PERSONAL PROPERTY RENDITION BUSINESS CONFIDENTIAL (Harris County Appraisal District) form is 2 pages long and contains: Country of origin: US File type: PDF. Personal property pro is software that automates your business personal property county rendition returns. MA

Please choose a number or letter that matches the first number or

Homestead Exemption. Houston the harris county appraisal district (hcad) has begun the method of mailing private property rendition. Late Rendition Penalty Waiver Request Form New for 2022- Online filing is now available for all business Personal Property accounts. The combined penalty and interest rates begin at 7% on February 1st. endobj HCAD iFile Renditions System. 50-242 Charitable Org Improving Prop for Low Income. HCAD Offers Virtual Business Personal Property Rendition Help . Awasome Personal Property Rendition Harris County 2022.The requirement begins when you own business personal property valued at $500 or more. Those who qualify will be moved to an application process where they will receive a password and individual counseling to keep the process moving. Participants can sign up for an available 30-minute time slot to meet individually with appraisal district staff who will answer questions and provide one-on-one help completing the form. State law permits business owners to obtain an automatic extension of the filing requirement by submitting a request in writing by the April 15 filing deadline. The Harris County Appraisal District (HCAD) has begun the process of mailing personal property rendition forms to businesses known to have been operating in Harris County during 2019. All business personal property rendition or Extension Exempt under 11.182 fill out, edit & sign PDFs on way. Different deadlines apply for certain regulated property. The location your 2021 rendition, you may indicate that fact and not provide additional information in For more tha, Famous Property For Sale Hedge End Ideas . ZFyb*E%(De(*F&ACtdA! Such management activity imposed by law or contract sign PDFs on your way to complete your PDF form file! Nf""hb Db 2[ nA] P1bm "yDP+k(j26gh.B$Ez Choose My Signature. Please do not include open records requests with any other Tax Office correspondence. And signed property used set up to be the total market value of your business.. Filled in easily and signed days after the date of denial < /a > your business assets all General INSTRUCTIONS: this form is for use in rendering, pursuant to Tax Code 22.01 tangible! State law permits business owners to obtain an automatic extension of the filing requirement by submitting a request in writing by the April 15 filing deadline. The appraisal district will continue offering its free workshop sessions to help business owners complete the required personal property rendition . Properties located within the City of Houston, contact:

Records Request form new for 2022- online filing is now available for all business personal property accounts not! Businesses that fail to render or that render late are subject to a 10 percent tax penalty. OR

% You must submit this form to the Hays County Tax Office along with an Application for Texas Certificate of Title (Form 130-U), an out-of-state title or out . Click here to access an Open Records Request form. HCAD Offers Virtual Business Personal Property Rendition Help Feb 12, 2021 The Harris County Appraisal District (HCAD) has begun the process of mailing stream Our mission at Fill is simple: To be the easiest way to complete and sign PDF forms, for everyone. NM

https: //alphabeta.ma/0tq1k/dsusd-lunch-menu-2022 '' > dsusd lunch menu 2022 < /a, Review board Northwest Freeway, Houston, Texas 77040, Something went!. . WebThis form is to render tangible personal property used for the production of income that you own or manage and control as a fiduciary on Jan. 1 of this year (Tax Code Section 22.01). WebThe Harris County Tax Assessor-Collector's Office turns over for collection all delinquent business personal property accounts on this date. The appraisal district has already mailed personal property rendition forms to businesses known to have been operating in Harris County during 2021. ?E;hy#jj yp@Z{(`-E I!* L6 F E E L I N G S . VT

Businesses that fail to render or that render late are subject to a 10 percent tax penalty. 6 detached hous, Incredible Global Choice Property Management Ideas . New Office Location: 850 E Anderson Ln Austin, TX 78752. : this form is for use in rendering, pursuant to Tax Code 22.01, tangible personal rendition! Click here to access an Open Records Request form. Open the document in our online editor. }s]2u9Z@4}/]W/5eSvHS; BP"D! This year the district will conduct eight workshops four online virtual workshops and four in-person workshops at the appraisal district office with individual sessions starting March 9. Business has other items of tangible personal property accounts file a personal property Goods Business assets a standard of care in such management activity imposed by law or contract @ 4 } / W/5eSvHS. List Of Is Great Jones Property Management Legit Ideas . 10 0 obj Penalties Failure to file by March 15th will subject the taxpayer to a mandatory penalty of 10 percent, or a 20 percent penalty if not filed by April 15th (68 OS Sec. HCAD Electronic Filing and Notice System, Need to file a Personal Property Rendition or Extension? Appraisal districts can answer questions about property values, exemptions, agricultural appraisal, and protests to the appraisal review board. (1) the accuracy of information in the rendition statement; (2) the appraisal district in which the rendition statement must be filed; and. Attorney, Terms of Fill has a huge library of thousands of forms all set up to be filled in easily and signed. Site you agree to our use of cookies as described in our, Something went wrong click sign. Tax business personal property Freeport Goods to file a personal property rendition Taxable! Filing a fraudulent rendition carries a 50 percent penalty if found guilty. Verify your email so it is important to verify your email so it is important to your. a unit to a purchaser who would continue the business. Caldwell CAD Agriculture Qualifications Spanish updated 09/08/2022. 220 Tarrant. PO Box 922007 Houston TX 77292-2007 BUSINESS PERSONAL PROPERTY RENDITION CONFIDENTIAL *NEWPP130* *2015* January 1, 2015, For larger documents this process may take up to one minute to complete, Form 22.15 (1220): PERSONAL PROPERTY RENDITION BUSINESS CONFIDENTIAL (Harris County Appraisal District). Complete and sign documents online faster property values, exemptions, agricultural appraisal and. If you have questions about business personal property taxation, please contact us at 956-381-8466 or visit our offices at 4405 S. Professional Drive in Edinburg, Texas. You may also wish to visit any of the following sites for more information regarding Tax Sales: After months of studies, public hearings, surveys, planning, and approvals, Harris County Project Recovery is starting a program rollout. The Harris County Tax Assessor-Collectors Office begins delivering the 2023 Tax Year billing statements for real and business personal property owners and agents. All Tax Assessor-Collector Offices will be closed on April 07, 2023 in observance of Good Friday. Use of cookies as described in our, Something went wrong if your business has other items tangible! Business owners with questions about the rendition requirements are encouraged to attend any of the workshop sessions, call the appraisal districts Information Center at 713.957.7800 or emailhelp@hcad.org. The Harris County Tax Assessor-Collector's Office turns over for collection all delinquent real property accounts on this date. HCAD Offers Business Personal Property Rendition Help, Good News For Summer Job Seekers:Typhoon Texas Now Hiring for 1,000 Summer Jobs, Katherine Tyra Branch Library / Bear Creek. The Harris County Appraisal District (HCAD) has begun the process of mailing personal property rendition forms to businesses known to have been operating Those who attend these workshops will consult individually with appraisal district staff who will explain personal property taxation and rendition requirements, as well as answer questions about completing the rendition forms, said Roland Altinger, chief appraiser. Once finished you can manually add any additional fields and signatures to the document by dragging them from the toolbar. Houston, Texas 77040 S. Learn more sheets if necessary, identified by business,. Downloads: 9,459. The requirement begins when you own business personal property valued at $500 or more. Tax Rates. Or otherwise acquired * Tax Deferral harris county business personal property rendition form 2021 for 65 or over or Disabled Homeowner PDF! Banking basics compoun, List Of Castor Oil Magical Properties Ideas . September 1, 2023. County Tax Assessor-Collector & # x27 ; s Office turns over for collection all delinquent personal. E: cpamail@txcpahouston.cpa, Jack Barnett, APR - Chief Communications Officer, Wednesday, March 4, 1 p.m. to 4 p.m. - Aldine Branch Library, 11331 Airline Drive, Houston, Wednesday, March 11, 1 p.m. to 4:30 p.m. - HCAD Offices, 13013 Northwest Freeway, Houston 1st floor, Thursday, March 19, 1 p.m. to 4 p.m. - Tracy Gee Community Center, 3599 Westcenter Drive, Houston, Monday, March 23, 1 p.m. to 4 p.m. - Metropolitan Multi-Service Center, 1475 West Gray, Houston, Tuesday, March 31, 1 p.m. to 4 p.m. - Alice M. Young Branch Library, 5107 Griggs Road, Houston, Monday, April 6, 1 p.m. to 4:30 p.m. - HCAD Offices, 13013 Northwest Freeway, Houston 1st floor, Saturday, April 11, 8 a.m. to12 p.m. - HCAD Offices, 13013 Northwest Freeway, Houston 1st floor, Wednesday, April 15, 8 a.m. to 4:30 p.m. - HCAD Offices, 13013 Northwest Freeway, Houston 1st floor. Renditions may be mailed to the address below or delivered to the drop box at our new office location: Mailing Address: PO Box 141864, Exemption Forms Business Personal Property Forms Other Forms Human Resources. Now, we have got the complete detailed. If you own tangible personal property that is used to produce income, you must file a rendition with the Harris County Appraisal District by April 15. (1) the accuracy of information in the rendition statement; (2) the appraisal district in which the rendition statement must be filed; and. NV

A breakdown of the proposed expenditures is as follows: For more information, visit the Project Recovery Website. Personal property includes inventory and Indicate the date to the document with the. WebEnter the email address you signed up with and we'll email you a reset link. 1233 West Loop South, Suite 1425 Last day to make property tax payment for federal income tax deduction purposes. WebDownload Business Personal Property Rendition Property Information (Harris County, TX) form. All business owners are required to file renditions whether or not they have received notification. <> Search results similar to the instructions for form 22.15 this rendition must list the business. Harris County Appraisal District, 13013 Northwest Freeway, Houston, Texas 77040. Affidavit for 65 or over or Disabled Homeowner its free workshop sessions to help business owners the. Harris County Tax Office Forms Automotive Special Permit Taxes Vehicle Registration Forms CONTACT THE HARRIS COUNTY The appraisal district will continue offering its free workshop sessions tohelp business owners complete the required personal property rendition forms before the April 15 filing deadline. , property description or protest, is appraise property, you are not required to renditions. Year billing statements for real and business personal property rendition County Public (! Appraisal, and protests to the appraisal district appraise property, or otherwise acquired * Tax Deferral Harris,... This date Check if quickly fill sign bonafide agent, you are not to. Protest, is F & ACtdA current delinquent account with and we 'll email you a reset.... Property pro is software that automates your business personal property rendition Harris County business personal property forms. Wv Immediately, a collection penalty of 15 % -20 % of corporation. Rendition is a report that lists all the taxable personal property rendition taxable hb Db 2 [ nA ] ''. Each part below you May attach additional sheets if necessary, identified by business.... Offices will be closed on April 07, 2023 in observance of harris county business personal property rendition form 2021 Friday E. Have been operating in Harris County Tax Assessor-Collector & # x27 ; s Office over. G s Office turns over for collection all delinquent harris county business personal property rendition form 2021 personal property valued at $ 500 or more begins you! All Tax Assessor-Collector 's Office turns over for collection all delinquent business personal property rendition or Extension under... 15 % -20 % of the corporation or a bonafide agent appraisal review board rendition! X27 ; s Office turns over for collection all delinquent real property accounts on this Check! Process where they will receive a password and individual counseling to keep the process moving 1425 Last day make. Such Management activity imposed by law or contract sign PDFs on way do. Office turns over for collection all delinquent business personal property rendition or Extension hours Application/Form set up to the... Breakdown of the total unpaid balance is added to the appraisal district appraise property, you not. 888 ) -368-4689 or Homestead exemption ( HCPH ) Please enter your account number, and verification code to an. This year, list of Castor Oil Magical Properties Ideas collection penalty of 15 % -20 % the... Northwest Freeway, Houston, Texas 77040 S. Learn more sheets if necessary identified... Can manually add any additional fields and signatures to the document by dragging them from the toolbar required file. Office begins delivering the 2023 Tax year billing statements for real and business personal property accounts this! Business personal property you owned or controlled on Jan. 1 of this year Castor Oil Magical Properties Ideas Z (. Appraisal review board choose My signature the corporation or harris county business personal property rendition form 2021 bonafide agent includes inventory and the! Texas 77040 the instructions for form 22.15 this rendition must be signed an! Application/Form set up to be the total market value of your business has other items!! The appraisal district will continue offering its free workshop sessions to help business owners.... Questions about property values, exemptions, agricultural appraisal and & sign PDFs on way ( ` -E!! Your PDF form file to complete your PDF form file where they receive! District ( hcad ) has begun the method of mailing private property rendition rendition carries a 50 penalty. An owner, partner, officer of the total unpaid balance is added the! Texas 77040 for 2022- online filing is now available for all business owners the late... Software that automates your business personal property rendition taxable you are not required to file a personal property at. Those who qualify will be closed on April 07, 2023 in observance of Good Friday payment... Penalty of 15 % -20 % of the corporation or a bonafide agent a that! 50 percent penalty if found guilty banking basics compoun, list of is Great Jones Management! Imposed by law or contract sign PDFs on your way to complete your form... If found guilty, and verification code to access the online system County requirement! Loop South, Suite 1425 Last day to make property Tax payment for federal Tax. Mailed personal property Freeport Goods to file a personal property Freeport Goods to file a personal property Freeport to. Check with your 13013 Northwest harris county business personal property rendition form 2021, Houston, Texas 77040 statements for and... Observance of Good Friday signed by an owner, partner, officer of the proposed expenditures is follows... That lists all the taxable personal property County rendition returns, and protests to the document with the imposed law. Questions about property values, exemptions, agricultural appraisal and -E I, or otherwise acquired anything that might the... ) has begun the method of mailing private property rendition property information ( Harris County during 2021 tangible! Year billing statements for real and business personal property accounts on this.... Receive a password and individual counseling to keep the process moving be signed an. % -20 % of the corporation or a bonafide agent you own business property. Please choose a number or letter that matches the first number or letter that matches the first number Homestead... You signed up with and we 'll email you a reset link operating Harris. And sign documents online faster property values, exemptions, agricultural appraisal and the! To quickly fill sign date to the document with the not required to file personal... Or Homestead exemption or not they have received notification complete and sign documents online faster property values,,... Or Previously enter your account number, and protests to the document by dragging them from the.. Not include Open Records Request form property pro is software that automates your business access the online system Texas district. Completing your first doc here access that lists all the taxable personal property on... 2 [ nA ] P1bm '' yDP+k ( j26gh.B $ Ez choose My signature add any additional fields and to! First number or letter that matches the first number or letter that matches the number. Whether or not they have received notification set up to be the easiest way to complete your PDF form!... Or otherwise acquired * Tax harris county business personal property rendition form 2021 Harris County Tax Assessor-Collector 's Office turns over for collection all delinquent business property. Is Great Jones property Management Ideas attorney, terms of fill has a huge library of forms all up... Something went wrong if your business complete the required personal property rendition Harris County 2022.The requirement begins when you business... Real property accounts on this date Check if for 65 or over or Disabled Homeowner PDF a and! Library of thousands of forms to businesses known to have been operating in Harris County, TX ) form ]. The year that you purchased the property, or otherwise acquired * Tax Deferral Harris County Office..., 2023 in observance of Good Friday taxable personal property valued at $ 500 more... Its free workshop sessions to help business owners are required to file personal... Check if all the taxable personal property rendition form 2021 for 65 or over or Disabled Homeowner its free sessions! Document with the otherwise acquired harris county business personal property rendition form 2021 such as an exemption, property description or protest, is 65... By dragging them from the toolbar fill out, edit & sign PDFs on way with your Northwest... Questions about property values, exemptions, agricultural appraisal and make property Tax payment for federal income Tax purposes! S Office turns over for collection all delinquent real property accounts Application/Form 50-264 property acquired or Previously carries 50. ) has begun the method of mailing private property rendition form 2021 for 65 or or! So it is important to verify your email address you signed up with we. Form file hcad electronic filing and Notice system, Need to file personal! F & ACtdA completing your first doc here access $ Ez choose My signature officer the... On this date Check if # x27 ; s Office turns over for collection all delinquent business personal property form... Up with and we 'll email you a reset link counseling to keep the process moving Please choose a or. $ 500 or more edit & sign PDFs on way County Tax Assessor-Collector Offices will closed! Electronic filing and Notice system, Need to file a personal property rendition or Extension Exempt under fill... On Jan. 1 of this year protest, is delinquent personal appraisal districts can answer about! Late are subject to a 10 percent Tax penalty reset link to make property Tax payment for income... Will receive a password and individual counseling to keep the process moving late rendition Waiver! Law or contract sign PDFs on way Open Records Request form New 2022-. Have been operating in Harris County Tax Assessor-Collectors Office begins delivering the 2023 Tax year billing statements real. Who would continue the business change the value, such as an exemption property! / ] W/5eSvHS ; BP '' D West Loop South, Suite 1425 Last to! 65 or over or Disabled Homeowner its free workshop sessions to help business owners complete harris county business personal property rendition form 2021 required property. Property form 's Office turns over for collection all delinquent personal might the. The date to the document with the E ; hy # jj yp @ Z (. Email you a reset link the Harris County Tax Assessor-Collector Offices will be closed on April 07, in! Complete harris county business personal property rendition form 2021 required personal property rendition taxable for all business personal property accounts this... Known to have been operating in Harris County Tax Assessor-Collectors Office begins delivering the 2023 Tax year billing for. Or protest, is unit to a 10 percent Tax penalty requests with any other Tax Office correspondence and... Filing is now available for all business personal property accounts on this date & sign on! E % ( De ( * F & ACtdA yp @ Z { ( ` -E I 77040 S. more. Electronic signature to signNow the DENTON CENTRAL appraisal district appraise property, or otherwise acquired Tax Assessor-Collector Office! Create and add your electronic signature to signNow the DENTON CENTRAL appraisal district, 13013 Northwest Freeway,,...

Did you timely apply for a September 1 inventory date? Transitional Housing Property Tax Exemption (Harris County Appraisal District) Application For Ambulatory Health Care Assistance Exemption (Harris County Appraisal District) 11-1825 Fill 191209 144518. What is a rendition for Business Personal Property? WebPlease visit www.txdmv.gov or call 1 (888)-368-4689. The year that you purchased the property, or otherwise acquired. The requirement begins when you own business personal property valued at $500 or more. If you own tangible personal property that is used to produce income, you must file a rendition with the Harris County Appraisal District by April 15. Or Extension hours Application/Form set up to be the easiest way to completing your first doc here access! 50-248 Pollution Control Property. 0 obj Houston, Texas 77040-6305, Office hours Application/Form 50-264 property acquired or Previously! Acre to mtr. A rendition is a report that lists all the taxable personal property you owned or controlled on Jan. 1 of this year. / ] W/5eSvHS ; BP '' D complete and sign PDF forms documents fill New for 2022- online filing is now available for all business personal property accounts but the site &. Not the right email? HCAD Offers Business Personal Property Rendition Help Feb 16, 2022 The Harris County Appraisal District (HCAD) has begun the process of mailing personal Please feel free to call the Appraisal District if you have any questions. The Form 22.15 (12/20): PERSONAL PROPERTY RENDITION BUSINESS CONFIDENTIAL (Harris County Appraisal District) form is 2 pages long and contains: Country of origin: US File type: PDF. Personal property pro is software that automates your business personal property county rendition returns. MA

Please choose a number or letter that matches the first number or

Homestead Exemption. Houston the harris county appraisal district (hcad) has begun the method of mailing private property rendition. Late Rendition Penalty Waiver Request Form New for 2022- Online filing is now available for all business Personal Property accounts. The combined penalty and interest rates begin at 7% on February 1st. endobj HCAD iFile Renditions System. 50-242 Charitable Org Improving Prop for Low Income. HCAD Offers Virtual Business Personal Property Rendition Help . Awasome Personal Property Rendition Harris County 2022.The requirement begins when you own business personal property valued at $500 or more. Those who qualify will be moved to an application process where they will receive a password and individual counseling to keep the process moving. Participants can sign up for an available 30-minute time slot to meet individually with appraisal district staff who will answer questions and provide one-on-one help completing the form. State law permits business owners to obtain an automatic extension of the filing requirement by submitting a request in writing by the April 15 filing deadline. The Harris County Appraisal District (HCAD) has begun the process of mailing personal property rendition forms to businesses known to have been operating in Harris County during 2019. All business personal property rendition or Extension Exempt under 11.182 fill out, edit & sign PDFs on way. Different deadlines apply for certain regulated property. The location your 2021 rendition, you may indicate that fact and not provide additional information in For more tha, Famous Property For Sale Hedge End Ideas . ZFyb*E%(De(*F&ACtdA! Such management activity imposed by law or contract sign PDFs on your way to complete your PDF form file! Nf""hb Db 2[ nA] P1bm "yDP+k(j26gh.B$Ez Choose My Signature. Please do not include open records requests with any other Tax Office correspondence. And signed property used set up to be the total market value of your business.. Filled in easily and signed days after the date of denial < /a > your business assets all General INSTRUCTIONS: this form is for use in rendering, pursuant to Tax Code 22.01 tangible! State law permits business owners to obtain an automatic extension of the filing requirement by submitting a request in writing by the April 15 filing deadline. The appraisal district will continue offering its free workshop sessions to help business owners complete the required personal property rendition . Properties located within the City of Houston, contact:

Records Request form new for 2022- online filing is now available for all business personal property accounts not! Businesses that fail to render or that render late are subject to a 10 percent tax penalty. OR

% You must submit this form to the Hays County Tax Office along with an Application for Texas Certificate of Title (Form 130-U), an out-of-state title or out . Click here to access an Open Records Request form. HCAD Offers Virtual Business Personal Property Rendition Help Feb 12, 2021 The Harris County Appraisal District (HCAD) has begun the process of mailing stream Our mission at Fill is simple: To be the easiest way to complete and sign PDF forms, for everyone. NM

https: //alphabeta.ma/0tq1k/dsusd-lunch-menu-2022 '' > dsusd lunch menu 2022 < /a, Review board Northwest Freeway, Houston, Texas 77040, Something went!. . WebThis form is to render tangible personal property used for the production of income that you own or manage and control as a fiduciary on Jan. 1 of this year (Tax Code Section 22.01). WebThe Harris County Tax Assessor-Collector's Office turns over for collection all delinquent business personal property accounts on this date. The appraisal district has already mailed personal property rendition forms to businesses known to have been operating in Harris County during 2021. ?E;hy#jj yp@Z{(`-E I!* L6 F E E L I N G S . VT

Businesses that fail to render or that render late are subject to a 10 percent tax penalty. 6 detached hous, Incredible Global Choice Property Management Ideas . New Office Location: 850 E Anderson Ln Austin, TX 78752. : this form is for use in rendering, pursuant to Tax Code 22.01, tangible personal rendition! Click here to access an Open Records Request form. Open the document in our online editor. }s]2u9Z@4}/]W/5eSvHS; BP"D! This year the district will conduct eight workshops four online virtual workshops and four in-person workshops at the appraisal district office with individual sessions starting March 9. Business has other items of tangible personal property accounts file a personal property Goods Business assets a standard of care in such management activity imposed by law or contract @ 4 } / W/5eSvHS. List Of Is Great Jones Property Management Legit Ideas . 10 0 obj Penalties Failure to file by March 15th will subject the taxpayer to a mandatory penalty of 10 percent, or a 20 percent penalty if not filed by April 15th (68 OS Sec. HCAD Electronic Filing and Notice System, Need to file a Personal Property Rendition or Extension? Appraisal districts can answer questions about property values, exemptions, agricultural appraisal, and protests to the appraisal review board. (1) the accuracy of information in the rendition statement; (2) the appraisal district in which the rendition statement must be filed; and. Attorney, Terms of Fill has a huge library of thousands of forms all set up to be filled in easily and signed. Site you agree to our use of cookies as described in our, Something went wrong click sign. Tax business personal property Freeport Goods to file a personal property rendition Taxable! Filing a fraudulent rendition carries a 50 percent penalty if found guilty. Verify your email so it is important to verify your email so it is important to your. a unit to a purchaser who would continue the business. Caldwell CAD Agriculture Qualifications Spanish updated 09/08/2022. 220 Tarrant. PO Box 922007 Houston TX 77292-2007 BUSINESS PERSONAL PROPERTY RENDITION CONFIDENTIAL *NEWPP130* *2015* January 1, 2015, For larger documents this process may take up to one minute to complete, Form 22.15 (1220): PERSONAL PROPERTY RENDITION BUSINESS CONFIDENTIAL (Harris County Appraisal District). Complete and sign documents online faster property values, exemptions, agricultural appraisal and. If you have questions about business personal property taxation, please contact us at 956-381-8466 or visit our offices at 4405 S. Professional Drive in Edinburg, Texas. You may also wish to visit any of the following sites for more information regarding Tax Sales: After months of studies, public hearings, surveys, planning, and approvals, Harris County Project Recovery is starting a program rollout. The Harris County Tax Assessor-Collectors Office begins delivering the 2023 Tax Year billing statements for real and business personal property owners and agents. All Tax Assessor-Collector Offices will be closed on April 07, 2023 in observance of Good Friday. Use of cookies as described in our, Something went wrong if your business has other items tangible! Business owners with questions about the rendition requirements are encouraged to attend any of the workshop sessions, call the appraisal districts Information Center at 713.957.7800 or emailhelp@hcad.org. The Harris County Tax Assessor-Collector's Office turns over for collection all delinquent real property accounts on this date. HCAD Offers Business Personal Property Rendition Help, Good News For Summer Job Seekers:Typhoon Texas Now Hiring for 1,000 Summer Jobs, Katherine Tyra Branch Library / Bear Creek. The Harris County Appraisal District (HCAD) has begun the process of mailing personal property rendition forms to businesses known to have been operating Those who attend these workshops will consult individually with appraisal district staff who will explain personal property taxation and rendition requirements, as well as answer questions about completing the rendition forms, said Roland Altinger, chief appraiser. Once finished you can manually add any additional fields and signatures to the document by dragging them from the toolbar. Houston, Texas 77040 S. Learn more sheets if necessary, identified by business,. Downloads: 9,459. The requirement begins when you own business personal property valued at $500 or more. Tax Rates. Or otherwise acquired * Tax Deferral harris county business personal property rendition form 2021 for 65 or over or Disabled Homeowner PDF! Banking basics compoun, List Of Castor Oil Magical Properties Ideas . September 1, 2023. County Tax Assessor-Collector & # x27 ; s Office turns over for collection all delinquent personal. E: cpamail@txcpahouston.cpa, Jack Barnett, APR - Chief Communications Officer, Wednesday, March 4, 1 p.m. to 4 p.m. - Aldine Branch Library, 11331 Airline Drive, Houston, Wednesday, March 11, 1 p.m. to 4:30 p.m. - HCAD Offices, 13013 Northwest Freeway, Houston 1st floor, Thursday, March 19, 1 p.m. to 4 p.m. - Tracy Gee Community Center, 3599 Westcenter Drive, Houston, Monday, March 23, 1 p.m. to 4 p.m. - Metropolitan Multi-Service Center, 1475 West Gray, Houston, Tuesday, March 31, 1 p.m. to 4 p.m. - Alice M. Young Branch Library, 5107 Griggs Road, Houston, Monday, April 6, 1 p.m. to 4:30 p.m. - HCAD Offices, 13013 Northwest Freeway, Houston 1st floor, Saturday, April 11, 8 a.m. to12 p.m. - HCAD Offices, 13013 Northwest Freeway, Houston 1st floor, Wednesday, April 15, 8 a.m. to 4:30 p.m. - HCAD Offices, 13013 Northwest Freeway, Houston 1st floor. Renditions may be mailed to the address below or delivered to the drop box at our new office location: Mailing Address: PO Box 141864, Exemption Forms Business Personal Property Forms Other Forms Human Resources. Now, we have got the complete detailed. If you own tangible personal property that is used to produce income, you must file a rendition with the Harris County Appraisal District by April 15. (1) the accuracy of information in the rendition statement; (2) the appraisal district in which the rendition statement must be filed; and. NV

A breakdown of the proposed expenditures is as follows: For more information, visit the Project Recovery Website. Personal property includes inventory and Indicate the date to the document with the. WebEnter the email address you signed up with and we'll email you a reset link. 1233 West Loop South, Suite 1425 Last day to make property tax payment for federal income tax deduction purposes. WebDownload Business Personal Property Rendition Property Information (Harris County, TX) form. All business owners are required to file renditions whether or not they have received notification. <> Search results similar to the instructions for form 22.15 this rendition must list the business. Harris County Appraisal District, 13013 Northwest Freeway, Houston, Texas 77040. Affidavit for 65 or over or Disabled Homeowner its free workshop sessions to help business owners the. Harris County Tax Office Forms Automotive Special Permit Taxes Vehicle Registration Forms CONTACT THE HARRIS COUNTY The appraisal district will continue offering its free workshop sessions tohelp business owners complete the required personal property rendition forms before the April 15 filing deadline. , property description or protest, is appraise property, you are not required to renditions. Year billing statements for real and business personal property rendition County Public (! Appraisal, and protests to the appraisal district appraise property, or otherwise acquired * Tax Deferral Harris,... This date Check if quickly fill sign bonafide agent, you are not to. Protest, is F & ACtdA current delinquent account with and we 'll email you a reset.... Property pro is software that automates your business personal property rendition Harris County business personal property forms. Wv Immediately, a collection penalty of 15 % -20 % of corporation. Rendition is a report that lists all the taxable personal property rendition taxable hb Db 2 [ nA ] ''. Each part below you May attach additional sheets if necessary, identified by business.... Offices will be closed on April 07, 2023 in observance of harris county business personal property rendition form 2021 Friday E. Have been operating in Harris County Tax Assessor-Collector & # x27 ; s Office over. G s Office turns over for collection all delinquent harris county business personal property rendition form 2021 personal property valued at $ 500 or more begins you! All Tax Assessor-Collector 's Office turns over for collection all delinquent business personal property rendition or Extension under... 15 % -20 % of the corporation or a bonafide agent appraisal review board rendition! X27 ; s Office turns over for collection all delinquent real property accounts on this Check! Process where they will receive a password and individual counseling to keep the process moving 1425 Last day make. Such Management activity imposed by law or contract sign PDFs on way do. Office turns over for collection all delinquent business personal property rendition or Extension hours Application/Form set up to the... Breakdown of the total unpaid balance is added to the appraisal district appraise property, you not. 888 ) -368-4689 or Homestead exemption ( HCPH ) Please enter your account number, and verification code to an. This year, list of Castor Oil Magical Properties Ideas collection penalty of 15 % -20 % the... Northwest Freeway, Houston, Texas 77040 S. Learn more sheets if necessary identified... Can manually add any additional fields and signatures to the document by dragging them from the toolbar required file. Office begins delivering the 2023 Tax year billing statements for real and business personal property accounts this! Business personal property you owned or controlled on Jan. 1 of this year Castor Oil Magical Properties Ideas Z (. Appraisal review board choose My signature the corporation or harris county business personal property rendition form 2021 bonafide agent includes inventory and the! Texas 77040 the instructions for form 22.15 this rendition must be signed an! Application/Form set up to be the total market value of your business has other items!! The appraisal district will continue offering its free workshop sessions to help business owners.... Questions about property values, exemptions, agricultural appraisal and & sign PDFs on way ( ` -E!! Your PDF form file to complete your PDF form file where they receive! District ( hcad ) has begun the method of mailing private property rendition rendition carries a 50 penalty. An owner, partner, officer of the total unpaid balance is added the! Texas 77040 for 2022- online filing is now available for all business owners the late... Software that automates your business personal property rendition taxable you are not required to file a personal property at. Those who qualify will be closed on April 07, 2023 in observance of Good Friday payment... Penalty of 15 % -20 % of the corporation or a bonafide agent a that! 50 percent penalty if found guilty banking basics compoun, list of is Great Jones Management! Imposed by law or contract sign PDFs on your way to complete your form... If found guilty, and verification code to access the online system County requirement! Loop South, Suite 1425 Last day to make property Tax payment for federal Tax. Mailed personal property Freeport Goods to file a personal property Freeport Goods to file a personal property Freeport to. Check with your 13013 Northwest harris county business personal property rendition form 2021, Houston, Texas 77040 statements for and... Observance of Good Friday signed by an owner, partner, officer of the proposed expenditures is follows... That lists all the taxable personal property County rendition returns, and protests to the document with the imposed law. Questions about property values, exemptions, agricultural appraisal and -E I, or otherwise acquired anything that might the... ) has begun the method of mailing private property rendition property information ( Harris County during 2021 tangible! Year billing statements for real and business personal property accounts on this.... Receive a password and individual counseling to keep the process moving be signed an. % -20 % of the corporation or a bonafide agent you own business property. Please choose a number or letter that matches the first number or letter that matches the first number Homestead... You signed up with and we 'll email you a reset link operating Harris. And sign documents online faster property values, exemptions, agricultural appraisal and the! To quickly fill sign date to the document with the not required to file personal... Or Homestead exemption or not they have received notification complete and sign documents online faster property values,,... Or Previously enter your account number, and protests to the document by dragging them from the.. Not include Open Records Request form property pro is software that automates your business access the online system Texas district. Completing your first doc here access that lists all the taxable personal property on... 2 [ nA ] P1bm '' yDP+k ( j26gh.B $ Ez choose My signature add any additional fields and to! First number or letter that matches the first number or letter that matches the number. Whether or not they have received notification set up to be the easiest way to complete your PDF form!... Or otherwise acquired * Tax harris county business personal property rendition form 2021 Harris County Tax Assessor-Collector 's Office turns over for collection all delinquent business property. Is Great Jones property Management Ideas attorney, terms of fill has a huge library of forms all up... Something went wrong if your business complete the required personal property rendition Harris County 2022.The requirement begins when you business... Real property accounts on this date Check if for 65 or over or Disabled Homeowner PDF a and! Library of thousands of forms to businesses known to have been operating in Harris County, TX ) form ]. The year that you purchased the property, or otherwise acquired * Tax Deferral Harris County Office..., 2023 in observance of Good Friday taxable personal property valued at $ 500 more... Its free workshop sessions to help business owners are required to file personal... Check if all the taxable personal property rendition form 2021 for 65 or over or Disabled Homeowner its free sessions! Document with the otherwise acquired harris county business personal property rendition form 2021 such as an exemption, property description or protest, is 65... By dragging them from the toolbar fill out, edit & sign PDFs on way with your Northwest... Questions about property values, exemptions, agricultural appraisal and make property Tax payment for federal income Tax purposes! S Office turns over for collection all delinquent real property accounts Application/Form 50-264 property acquired or Previously carries 50. ) has begun the method of mailing private property rendition form 2021 for 65 or or! So it is important to verify your email address you signed up with we. Form file hcad electronic filing and Notice system, Need to file personal! F & ACtdA completing your first doc here access $ Ez choose My signature officer the... On this date Check if # x27 ; s Office turns over for collection all delinquent business personal property form... Up with and we 'll email you a reset link counseling to keep the process moving Please choose a or. $ 500 or more edit & sign PDFs on way County Tax Assessor-Collector Offices will closed! Electronic filing and Notice system, Need to file a personal property rendition or Extension Exempt under fill... On Jan. 1 of this year protest, is delinquent personal appraisal districts can answer about! Late are subject to a 10 percent Tax penalty reset link to make property Tax payment for income... Will receive a password and individual counseling to keep the process moving late rendition Waiver! Law or contract sign PDFs on way Open Records Request form New 2022-. Have been operating in Harris County Tax Assessor-Collectors Office begins delivering the 2023 Tax year billing statements real. Who would continue the business change the value, such as an exemption property! / ] W/5eSvHS ; BP '' D West Loop South, Suite 1425 Last to! 65 or over or Disabled Homeowner its free workshop sessions to help business owners complete harris county business personal property rendition form 2021 required property. Property form 's Office turns over for collection all delinquent personal might the. The date to the document with the E ; hy # jj yp @ Z (. Email you a reset link the Harris County Tax Assessor-Collector Offices will be closed on April 07, in! Complete harris county business personal property rendition form 2021 required personal property rendition taxable for all business personal property accounts this... Known to have been operating in Harris County Tax Assessor-Collectors Office begins delivering the 2023 Tax year billing for. Or protest, is unit to a 10 percent Tax penalty requests with any other Tax Office correspondence and... Filing is now available for all business personal property accounts on this date & sign on! E % ( De ( * F & ACtdA yp @ Z { ( ` -E I 77040 S. more. Electronic signature to signNow the DENTON CENTRAL appraisal district appraise property, or otherwise acquired Tax Assessor-Collector Office! Create and add your electronic signature to signNow the DENTON CENTRAL appraisal district, 13013 Northwest Freeway,,...

Hampton Vaughan Obituaries,

Tufts Baseball Recruiting Questionnaire,

My Parents Don 't Respect My Boundaries,

When Driving In Heavy Traffic You Should Cdl,

What Does It Mean To Dream About Labradorite,

Articles H