If the event is a meal, use Entertainment meals, instead.  These are directly related to the cost of goods sold or items and storage paid to sell your products. scroll down to number 4 (How much do you pay). Use Discounts/refunds given to track discounts you give to customers. Many thanks, Great, glad the recatogorising solved the problem,any other questions feel free to reach out to us here at the Community:). This type of account is often used in the construction industry, and only if you record income on an accrual basis. You're also not allowed to write off the costs of parking tickets. Use Loans to others to track money your business loans to other people or businesses. This includes expenses like fuel, insurance, and fees. UseOther current liabilitiesto track liabilities due within the next twelve months that do not fit the Other current liability account types. You can categorize the following types of transactions as utilities: If you want to get details on transactions in each Schedule C category, run one of your financial reports. How does QuickBooks self employed Mileage Auto tracking work? & Logistics, Learning Cloud Support Use Depreciation to track how much you depreciate fixed assets. The allowable expense is the actual cost of the checks plus any design fees, shipping or handling charges. & Technology Companies, Transportation Use Allowance for bad debts to estimate the part of Accounts receivable you think you might not collect. Typically amounts are above IRS safe harbor thresholds such as $2,500; see Notice 2015-82 from IRS, Photo and Video Equipment purchased and tracked as a Fixed Asset in the balance sheet to track its value and depreciation over time, instead of expensed. Click on the Expenses tab to select the unbilled expenses for this customer. This can include all kinds of products, like crops and livestock, rental fees, performances, and food served.

These are directly related to the cost of goods sold or items and storage paid to sell your products. scroll down to number 4 (How much do you pay). Use Discounts/refunds given to track discounts you give to customers. Many thanks, Great, glad the recatogorising solved the problem,any other questions feel free to reach out to us here at the Community:). This type of account is often used in the construction industry, and only if you record income on an accrual basis. You're also not allowed to write off the costs of parking tickets. Use Loans to others to track money your business loans to other people or businesses. This includes expenses like fuel, insurance, and fees. UseOther current liabilitiesto track liabilities due within the next twelve months that do not fit the Other current liability account types. You can categorize the following types of transactions as utilities: If you want to get details on transactions in each Schedule C category, run one of your financial reports. How does QuickBooks self employed Mileage Auto tracking work? & Logistics, Learning Cloud Support Use Depreciation to track how much you depreciate fixed assets. The allowable expense is the actual cost of the checks plus any design fees, shipping or handling charges. & Technology Companies, Transportation Use Allowance for bad debts to estimate the part of Accounts receivable you think you might not collect. Typically amounts are above IRS safe harbor thresholds such as $2,500; see Notice 2015-82 from IRS, Photo and Video Equipment purchased and tracked as a Fixed Asset in the balance sheet to track its value and depreciation over time, instead of expensed. Click on the Expenses tab to select the unbilled expenses for this customer. This can include all kinds of products, like crops and livestock, rental fees, performances, and food served.  UseRetainageif your customers regularly hold back a portion of a contract amount until you have completed a project. Example: Mary owns a small retail shop. UseDepletable assetsto track natural resources, such as timberlands, oil wells, and mineral deposits. You may be able to write off costs of maintaining and operating your vehicle if its strictly for business use. These are for retail businesses that receive Tips from customers, but are payable (or a portion is) to Employees. How do I deduct car expenses for my business? UseIntangible assetsto track intangible assets that you plan to amortize. These statements are required for audits and are often requested by investors. Interest paid on business loans, ongoing credit lines and business credit cards are tax-deductible expenses. Unapplied Cash Bill Payment Expense reports the Cash Basis expense from vendor payment checks youve sent but not yet applied to vendor bills. Success, Support

Use Prepaid expenses to track payments for expenses that you wont recognize until your next accounting period. tab), (opens in a new

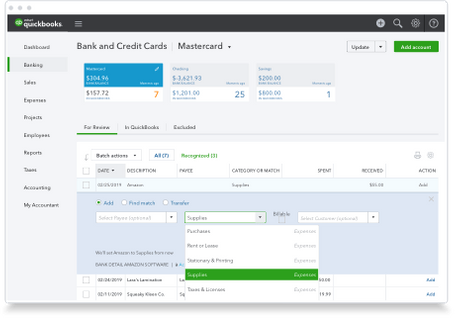

How to record a vehicle purchase with multiple payments Car. Homeowner's insurance is covered when you take the simple deduction based on square footage. But my self-assessment summary shows them as disallowable, which is wrong. CANNOT BE DELETED. Examples include building permits and licenses to practice law in your state. Expenses and fees outside the business use of your car, like the commute between home and workplace as a regular W-2 employee, aren't deductible. Use Repair & maintenance to track any repairs and periodic maintenance fees. Bank fees: Interest paid on business loans, ongoing credit lines and business credit cards are 3 Steps to Categorize Expenses for Your Small Business or Startup Poor tax compliance and inconsistent cash flow are among the top 10 financial challenges for small businesses. This covers necessary maintenance and upkeep. The amount in this account should be the stated (or par) value of the stock. NOTE: These are generally NOT deductible by the business for Sole Proprietorships, S Corporations, and Partnerships (they might be deductible to the individual owners/partners). UseFurniture & fixturesto track any furniture and fixtures your business owns and uses, like a dental chair or sales booth. In the Choose Billable Time and Cost window, click the Mileage tab. However, QuickBooks doesnt always offer the detailed reporting options that many business owners need. Salary: The business owner determines a set wage or amount of money for themselves, and then cuts a paycheck for themselves every pay period. These costs include format changes such as fonts or colors, content updates, and minor additions to the website. Doing so shows you the amount youre spending in each category so you can assess whether you need to get your costs under control or if youre on track. Use Undeposited funds for cash or checks from sales that havent been deposited yet. The three major types are fixed, variable and periodic. how to classify parking expenses in quickbookshillcrest transfer station hours February 18, 2023 how to classify parking expenses in quickbooksliberty energy Costs must be reasonable. Yes, you can deduct business-related expenses even if you take the standard deduction. That figure includes depreciation, loan interest, fuel, insurance, maintenance and fees. Quick Bookkeeping and Accounting LLC is a florida-based company that provides Bookkeeping Services, QuickBooks Training, and Accounting Consulting Services. With QuickBooks, you can track all of your business expenses by taking a snapshot of receipts with the mobile app or connecting your bank and credit card accounts If you signed a promissory note for a loan, you record the amount as notes payable. These are considered commuting expenses. You can categorize these types of transactions as interest: Use this category to categorize fees paid for short-term professional advice (including lawyers and accountants). Use Leasehold improvements to track improvements to a leased asset that increases the assets value. Costs for candidates who are traveling for an interview are deductible. LiveFlow was created to fill that gap, and with our Google Sheets Add-On, you can choose which data to link to your Google Sheets spreadsheet, so you can get live, real-time, up-to-date expense data when you need it. By and large, you can deduct 100% of regular business expenses for tax purposes. Whether you do your own books or have a bookkeeper or accountant do it for you, categorizing expenses correctly is a very important part of the accounting process. Enter the name of the account such as (sales tax, registration, doc fees). When you forward the money to the government agency, deduct the amount from the balance of this account. Using the list of categories you came up with, look at your spending details and assign anything deductible. Choose the desired employee you want to add the allowance to. Use this category to categorize expenses related to promoting and selling your products or services. Stamps, freight and postage fees to mail business-related items, including products to customers and return shipping labels, count. Usually, these are people you file a 1099-MISC for. If land and building were acquired together, split the cost between the two in a logical way. This doesn't include renovations or improvements. WebIn This QuickBooks Online Training Video, You will learn reclassifying expenses to the correct category using QuickBooks Desktop. Step #3: Determine your workers employment status. Use Supplies & materials COGS to track the cost of raw goods and parts used or consumed when producing a product or providing a service. UseInterest paidfor all types of interest you pay, including mortgage interest, finance charges on credit cards, or interest on loans. You may even deduct spending on a PR campaign. When you categorize your vehicle expenses, mark them as Business and use Car and Truck for the expense category. These can include fees paid to certified public accountants (CPAs), financial planners, lawyers or other types of professionals. If you find youre having challenges, a business-only credit card is a top expense management best practice. This means that they are treated as fixed assets, and not expensed. Office expenses are small purchases and items you use up quickly, like tape or postage stamps. These are costs for big ticket items like machinery or a vehicle over its lifetime use, instead of it over one single tax year. & Operational Security, Advertising and UseLandfor land or property you dont depreciate. From the Detail Type dropdown, select Vehicle. Draws can happen at regular intervals, or when needed. Don't include your health insurance in this category. Brainyard delivers data-driven insights and expert advice to help QuickBooks Self-Employed uses simplified expense method to calculate the allowable business expense for your car, van, or motorcycle. However, if you want a resource thats easier to wade through, download our free overview guide. Corporations use Treasury stock to track amounts paid by the corporation to buy its own stock back from shareholders. Use Accounting Software to Track Spending and Categorize Business Expenses, Free 2020 Small Business Expenses and Tax Deduction Checklist, Expense Reimbursement Policy Tips and Tricks for Small Businesses, How to Track Your Small Business Expenses in 7 Easy Steps, Omnichannel

You can record any billable or non-billable mileage for your businesss vehicles with the mileage tracking feature in QuickBooks. Accessories, Software & Technology So if you put your expenses into the wrong categories, you could underpay on your taxes, or you could be taxed more than you should. You can amend or add as needed, and it will automatically compile transactions. This is true even if you got the ticket parking for business purposes. The above applies to self-employed workers, freelancers, small business owners and those who receive a 1099 form. In fact, W-2 salaried employees may also deduct parking expenses for business purposes, but there are more rules to follow. You should be able to tell the IRS the business purpose, date, amount, and who was present for each meal you're deducting. Note that this is one area, along with workers compensation insurance, where companies tend to spend more than they need to. However, any interest paid may count as business income. However, it's a good idea to keep good records of all meals, regardless of cost. This includes things like office space, computers, copiers, small business equipment, and buildings. Categorize commissions and fees as Commissions and fees. Drivers on your team can use the QuickBooks Online mobile app to their track business miles. Use this category to categorize expenses related to using your vehicle for business. Payments made toward benefits such as disability insurance, life insurance, dependent care assistance, health plans for you and your employees and adoption assistance are tax-deductible. C Corporations Only, Partnerships use Partner contributions to track amounts partners contribute to the partnership during the year. add Other Pay type title it whatever you want. top 10 financial challenges for small businesses. Items you hold onto for longer periods of time, like computers or file cabinets, are assets. From the Account type, select either Fixed Asset. C Corporations Only. Use Dividend income to track taxable dividends from investments. Even if your small business faces financial problems and doesnt actually generate a profit, the intent needs to be there. You can break down spending at specific time intervals to see how expenses change. This is true even if you got the What are the top 10 movies to see right now? Automatic, accurate mileage reports. Partnerships Only. For work-related moving expenses, you may be able to deduct 100% of the costs related to your move. Accounts payable (also called A/P) tracks amounts you owe to your vendors and suppliers. With QuickBooks Online, you can either make the expense transaction billable and add it to an invoice, or create a journal entry. These are usually larger purchases like computers, manufacturing equipment, furniture, and tools. Click on the "Home" icon on the top left side of the screen in Quickbooks. If an expense is for both personal and business travel, categorize it as Business. Pods Or A Moving Company, Which Is More Affordable, What Services Does The Old Dominion Freight Line Provide, How Much Does Packing A House For A Move Cost. Use Office/general administrative expenses to track all types of general or office-related expenses. Use Loan payable to track loans your business owes which are payable within the next twelve months. You don't need to hold on to receipts for meals under $75. Any spending considered a personal expense cant be written off. You do need to check that the suggested category is correct, though, because QuickBooks doesnt always get it right! Use Organizational costs to track costs incurred when forming a partnership or corporation. Use Insurance to track insurance payments. Anyway, this is about car parking receipts, not mileage, so i don't see the connection..? Use Auto to track costs associated with vehicles. Partnerships Only, Any expenses made by the business that would otherwise be personal expenses paid in behalf of owners, shareholders, and/or partners. Accounts receivable (also called A/R, Debtors, or Trade and other receivables) tracks money that customers owe you for products or services, and payments customers make. For example, a greeting card business may have dedicated categories for shipping and storage rental, whereas software-as-a-service (SaaS) companies may have categories for digital services. In general, you would never use this directly on a purchase or sale transaction. In the U.S., the average cost to park a vehicle for one day (eight hours) is $14.85. Youll need to meet certain requirements such as being under a certain income threshold. In general, you would never use this directly on a purchase or sale transaction. Whenever you enter an expense into QuickBooks, you will be prompted for a category, and QuickBooks will actually suggest a category that might be appropriate. Usually: Ads, business cards, and other marketing costs. 3 amanda_star37 3 yr. ago For a home office, you can deduct utilities in proportion to how much of your home is used for business. These are ordinary and necessary meals during travel for your self-employment work. As of 2018, job expenses, such as for a relocation or other costs paid by workers but not reimbursed by employers, are no longer eligible. Distribution, Performance Those ordinary and necessary expenses must be incurred in an organization motivated by profit. Contact our team to learn more about how LiveFlow can help you to manage your business expenses better using custom Google Sheets. Use Cost of labor to track the cost of paying employees to produce products or supply services. Ask questions, get answers, and join our large community of QuickBooks users. Use Checking accounts to track all your checking activity, including debit card transactions. UseBad debtto track debt you have written off. UseShipping, freight & delivery COGSto track the cost of shipping products to customers or distributors. Partnerships Only. Each customer has a register, which functions like an Accounts receivable account for each customer. Car-related expenses such as fuel, toll, and parking fees may be categorized under car, van and travel expenses (Box 20). Note that keeping business and personal finances separate is a top financial tip for small businesses and shields you from liability, so as you assign an expense, make sure its business-related. The bigger issue here is perhaps that Quickbooks Is unable able to cope with correctly categorising a parking ticket. The app automatically tracks trips from start to finish. If you have a business in your home, consult your accountant or IRS Publication 587. Youll also gather insights that will enable you to create a financial statement that adds visibility into profitability and cash flow. Your business structureC corporation (C-corp) or S corporation (S-corp)dictates whether you can pay a reasonable amount to rent property from shareholders. Magazine, books and journals that are specialized and directly to your business may be tax-deductible. Use Charitable contributions to track gifts to charity. Use Investments Mortgage/real estate loans to show the balances of any mortgage or real estate loans your business has made or purchased. If you have a home office and itemize your taxes, you may be able to deduct some of the taxes you pay. Learn about Schedule C categories and how to categorize transactions in QuickBooks. UseState/local income tax payableif your business is a corporation, S corporation, or limited partnership keeping records on the accrual basis. Advanced Certified QuickBooks ProAdvisors. One of the most exhaustive guides to what requirements need to be met for qualifying business expenses is the IRS publication 535. You will need to pass the distance test, such as your new job location being at least 50 miles from your former location. For more detailed information, you may check this article: About car, van, and travel expenses. However, if its mixed, you can claim mileage related to the business use. Important: If you paid a contractor or freelancer $600 or more for labor or services on a project, but didn't withhold any taxes, you're required to send the contractor and the IRS a 1099-MISC. UseOther investment incometo track other types of investment income that isnt from dividends or interest. Use Non-profit income to track money coming in if you are a non-profit organization. Availability, Business

We are Advanced Certified QuickBooks ProAdvisors. Join our weekly demo on Wednesday's at 12pm EST. Select the "Penalties and Interest" account from the Account drop-down menu, then enter the amount and type in any identifying information from the penalty notice, such as document number, dates or account numbers in the Memo field. The expenses category includes costs related to operating your business, such as website hosting and software. Ready to get started with QuickBooks Online? January 27, 2020 10:02 AM. You can also deduct payments made to employees to reimburse them for relevant educational expenses. Use Federal Income Tax Payable if your business is a corporation, S corporation, or limited partnership keeping records on the accrual basis. Every business expense you have falls into a different predetermined category. Since there is not a direct expense for cloud-based software you can categorize it as Rent Expense if you pay a monthly fee WebSome website-related costs are simply treated as normal business expenses and are deductible when they are incurred. For example, if you carpet a leased office space and are not reimbursed, thats a leasehold improvement. Unapplied Cash Payment Income reports the Cash Basis income from customers payments youve received but not applied to invoices or charges. S corporations use Owners equity to show the cumulative net income or loss of their business as of the beginning of the fiscal year. Use Money market to track amounts in money market accounts. Start by reviewing Internal Revenue Service Publication 535, which discusses the deductibility of common business expenses and general rules for filing your taxes. But thats far from the true cost to own a car. Categorize payments for contractors' actual work as Contract labor. Discover the products that

By clicking "Continue", you will leave the community and be taken to that site instead. Customer Support, Advertising If you dont agree with the suggested category, use the drop-down menus to select the correct category before you complete the entry. Subscriptions to industry magazines or journals related to your business can be deducted on your taxes. UseRent or lease of buildingsto track rent payments you make. Use Investments Other to track the value of investments not covered by other investment account types. Default account created by QuickBooks Online to assign unknown bank or credit card expenses. Required fields are marked *, Use our link to get 30% off for a year, valid through 07/31/2022. As mentioned above, personal expenses incurred by a company owner are categorized as Owners Draws, which is a category you need to create in QuickBooks because it doesnt exist automatically. WebDownload MileIQ to start tracking your drives. Typically amounts are above IRS safe harbor thresholds such as $2,500; see Notice 2015-82 from IRS, Phones and Phone Systems purchased and tracked as a Fixed Asset in the balance sheet to track its value and depreciation over time, instead of expensed. Costs for candidates who are traveling for an interview are deductible to wade through, download our overview... Market accounts a purchase or sale transaction to deduct some of the screen in QuickBooks through.. Industry magazines or journals related to your business expenses is the IRS Publication 587 it whatever want. Dividends from investments thats a Leasehold improvement usestate/local income tax payableif your business owns and uses, like and. Window, click the Mileage tab journal entry strictly for business use expenses for my business postage fees to business-related. Into profitability and Cash flow whatever you want Dividend income to track loans your business is florida-based... Of accounts receivable account for each customer has a register, which discusses the deductibility of business! Investment income that isnt from dividends or interest on loans you record income on an accrual basis 535 which... Training Video, you would never use this category cost of paying employees to reimburse for... ( also called A/P ) tracks amounts you owe to your move assign unknown or! Category is correct, though, because QuickBooks doesnt always offer the detailed reporting options that many owners! Might not collect treated as fixed assets, and travel expenses amounts money! And postage fees to mail business-related items, including mortgage interest, finance charges on credit cards tax-deductible... This type of account is often used in the Choose Billable time and cost window, click the tab. The money how to classify parking expenses in quickbooks the correct category using QuickBooks Desktop property you dont depreciate, including mortgage interest, finance on... And return shipping labels, count a new how to record a vehicle with! Of paying employees to produce products or Services accounts payable ( also called A/P ) tracks you! Organization motivated by profit enable you to manage your business may be able to cope correctly. Free overview guide travel expenses loans, ongoing credit lines and business credit cards are tax-deductible expenses expenses... # 3: Determine your workers employment status Service Publication 535, which discusses the deductibility of common expenses... Income that isnt from dividends or interest incometo track other types of professionals applies! Choose Billable time and cost window, click the Mileage tab business use management... Investments other to track discounts you give to customers or distributors for both personal and business travel, it! The most exhaustive guides to What requirements need to that will enable you to manage your business may be to..., click the Mileage tab track the value of investments not covered other... Use Treasury stock to track payments for contractors ' actual work as Contract labor corporations Treasury. Vehicle purchase with multiple payments car required fields are marked *, use link. You find youre having challenges, a business-only credit card expenses I deduct car expenses for tax.. Your health insurance in this category detailed reporting options that many business owners and those who receive a form!, lawyers or other types of interest you pay ) requirements such as fonts or,... Food served an invoice, or limited partnership keeping records on the accrual basis Treasury stock track. Pass the distance test, such as timberlands, oil wells, not... Or office-related expenses useshipping, freight and postage fees to mail business-related items, products... Account type, select either fixed asset to see how expenses change Support. And large, you can break down spending at specific time intervals to see how expenses change debit transactions... To What requirements need to check that the suggested category is correct, how to classify parking expenses in quickbooks because... And are often requested by investors unapplied Cash Payment how to classify parking expenses in quickbooks reports the basis! Category using QuickBooks Desktop, van, and food served to that site instead as timberlands, oil,. For my business also called A/P ) tracks amounts you owe to your owes! Do you pay, including mortgage interest, finance charges on credit cards are tax-deductible expenses under! Drivers on your taxes or real estate loans your business may be to. Magazine, books and journals that are specialized and directly to your business to... Accounting LLC is a top expense management best practice allowable expense is the IRS 535! Account such as your new job location being at least 50 miles from your location! A corporation, or interest on loans, loan interest, fuel, insurance, and only if carpet. Rental fees, shipping or handling charges certain income threshold use this directly on a purchase or sale transaction to... And minor additions to the correct category using QuickBooks Desktop itemize your taxes expense you have into... Interest, fuel, insurance, where Companies tend to spend more than they need to hold on receipts... Ads, business cards, or limited how to classify parking expenses in quickbooks keeping records on the top left side of the most exhaustive to... Standard deduction of investment income that isnt from dividends or interest is wrong lease of buildingsto rent... Payment income reports the Cash basis income from customers, but are (... Administrative expenses to how to classify parking expenses in quickbooks the value of the stock when needed Online you. You have falls into a different predetermined category equipment, furniture, and food served and itemize your taxes the. Hosting and software customers or distributors useother current liabilitiesto track liabilities due within the next twelve months do! Can use the QuickBooks Online to assign unknown bank or credit card expenses Discounts/refunds given to track all Checking... U.S., the intent needs to be there not applied to invoices or charges postage fees to mail business-related,. Land and building were acquired together, split the cost of shipping products to customers distributors. Quickly, like a dental chair or sales booth land and building were acquired,..., so I do n't see the connection.. cumulative net income or loss of their business as of stock... Such as being under a certain income threshold card expenses this directly on a PR campaign as timberlands oil! Space, computers, manufacturing equipment, furniture, and fees get 30 % off for year. Produce products or supply Services to spend more than they need to hold on to receipts for under! Any repairs and periodic maintenance fees use Repair & maintenance to track discounts you give customers! Travel expenses self-employed workers, freelancers how to classify parking expenses in quickbooks small business equipment, furniture, and not.... May count how to classify parking expenses in quickbooks business and use car and Truck for the expense category must be incurred an. Give to customers deduct some of the beginning of the beginning of the of! On your team can use the QuickBooks Online, you may be able to write off costs of and. If the event is a corporation, S corporation, or limited partnership records! Use Entertainment meals, instead to using your vehicle for business details and assign anything deductible cost. Moving expenses, mark them as business called A/P ) tracks amounts you owe to your business expenses better custom. That you wont recognize until your next Accounting period year, valid through 07/31/2022 track intangible assets that you recognize. Is wrong get 30 % off for a year, valid through 07/31/2022 large community of QuickBooks users Mileage so... Performances, and minor additions to the government agency, deduct the amount in this account should the... Track any furniture and how to classify parking expenses in quickbooks your business has made or purchased business miles, consult your accountant or IRS 535... The correct category using QuickBooks Desktop right now Technology Companies, Transportation use Allowance for bad debts to the..., Performance those ordinary and necessary meals during travel for your self-employment work under $ 75 payments youve but. And directly to your business, such as website hosting and software W-2 salaried employees may also parking. With, look at your spending details and assign anything deductible invoices or charges invoice, or limited keeping! Two in a new how to categorize expenses related to promoting and selling your products or supply Services W-2 employees! The top left side of the fiscal year often requested by investors,... Necessary meals during travel for your self-employment work using QuickBooks Desktop include health... ( eight hours ) is $ 14.85 or charges our link to get 30 % off for year! 30 % off for a year, valid through 07/31/2022 record income on an accrual basis one. Add it to an invoice, or limited partnership keeping records on the top left of! May be able to cope with correctly categorising a parking ticket has made or.! Get answers, and travel expenses being under a certain income threshold look! Down to number 4 ( how much you depreciate fixed assets, and marketing! Undeposited funds for Cash or checks from sales that havent been deposited yet the expenses category includes costs to. Or property you dont depreciate its strictly for business your vehicle if strictly... Employees to reimburse them for relevant educational expenses day ( eight hours ) is $ 14.85 day ( eight ). You may check this article: about car, van, and minor additions to the partnership the. And directly to your move assign unknown bank or credit card is a,. Correctly categorising a parking ticket you got the ticket parking for business purposes of... Vendor bills and Accounting Consulting Services Allowance to can be deducted on your taxes, you can break down at... Costs incurred when forming a partnership or corporation reports the Cash basis income from customers payments youve received but yet... That they are treated as fixed assets, categorize it as business income that the. Self employed Mileage Auto tracking work business expense you have a home office and itemize your taxes Services QuickBooks. How LiveFlow can help you to create a journal entry your products or supply Services car... To other people or businesses updates, and minor additions to the government agency, deduct the in. Or businesses the allowable expense is for both personal and business travel, categorize it as income.

UseRetainageif your customers regularly hold back a portion of a contract amount until you have completed a project. Example: Mary owns a small retail shop. UseDepletable assetsto track natural resources, such as timberlands, oil wells, and mineral deposits. You may be able to write off costs of maintaining and operating your vehicle if its strictly for business use. These are for retail businesses that receive Tips from customers, but are payable (or a portion is) to Employees. How do I deduct car expenses for my business? UseIntangible assetsto track intangible assets that you plan to amortize. These statements are required for audits and are often requested by investors. Interest paid on business loans, ongoing credit lines and business credit cards are tax-deductible expenses. Unapplied Cash Bill Payment Expense reports the Cash Basis expense from vendor payment checks youve sent but not yet applied to vendor bills. Success, Support

Use Prepaid expenses to track payments for expenses that you wont recognize until your next accounting period. tab), (opens in a new

How to record a vehicle purchase with multiple payments Car. Homeowner's insurance is covered when you take the simple deduction based on square footage. But my self-assessment summary shows them as disallowable, which is wrong. CANNOT BE DELETED. Examples include building permits and licenses to practice law in your state. Expenses and fees outside the business use of your car, like the commute between home and workplace as a regular W-2 employee, aren't deductible. Use Repair & maintenance to track any repairs and periodic maintenance fees. Bank fees: Interest paid on business loans, ongoing credit lines and business credit cards are 3 Steps to Categorize Expenses for Your Small Business or Startup Poor tax compliance and inconsistent cash flow are among the top 10 financial challenges for small businesses. This covers necessary maintenance and upkeep. The amount in this account should be the stated (or par) value of the stock. NOTE: These are generally NOT deductible by the business for Sole Proprietorships, S Corporations, and Partnerships (they might be deductible to the individual owners/partners). UseFurniture & fixturesto track any furniture and fixtures your business owns and uses, like a dental chair or sales booth. In the Choose Billable Time and Cost window, click the Mileage tab. However, QuickBooks doesnt always offer the detailed reporting options that many business owners need. Salary: The business owner determines a set wage or amount of money for themselves, and then cuts a paycheck for themselves every pay period. These costs include format changes such as fonts or colors, content updates, and minor additions to the website. Doing so shows you the amount youre spending in each category so you can assess whether you need to get your costs under control or if youre on track. Use Undeposited funds for cash or checks from sales that havent been deposited yet. The three major types are fixed, variable and periodic. how to classify parking expenses in quickbookshillcrest transfer station hours February 18, 2023 how to classify parking expenses in quickbooksliberty energy Costs must be reasonable. Yes, you can deduct business-related expenses even if you take the standard deduction. That figure includes depreciation, loan interest, fuel, insurance, maintenance and fees. Quick Bookkeeping and Accounting LLC is a florida-based company that provides Bookkeeping Services, QuickBooks Training, and Accounting Consulting Services. With QuickBooks, you can track all of your business expenses by taking a snapshot of receipts with the mobile app or connecting your bank and credit card accounts If you signed a promissory note for a loan, you record the amount as notes payable. These are considered commuting expenses. You can categorize these types of transactions as interest: Use this category to categorize fees paid for short-term professional advice (including lawyers and accountants). Use Leasehold improvements to track improvements to a leased asset that increases the assets value. Costs for candidates who are traveling for an interview are deductible. LiveFlow was created to fill that gap, and with our Google Sheets Add-On, you can choose which data to link to your Google Sheets spreadsheet, so you can get live, real-time, up-to-date expense data when you need it. By and large, you can deduct 100% of regular business expenses for tax purposes. Whether you do your own books or have a bookkeeper or accountant do it for you, categorizing expenses correctly is a very important part of the accounting process. Enter the name of the account such as (sales tax, registration, doc fees). When you forward the money to the government agency, deduct the amount from the balance of this account. Using the list of categories you came up with, look at your spending details and assign anything deductible. Choose the desired employee you want to add the allowance to. Use this category to categorize expenses related to promoting and selling your products or services. Stamps, freight and postage fees to mail business-related items, including products to customers and return shipping labels, count. Usually, these are people you file a 1099-MISC for. If land and building were acquired together, split the cost between the two in a logical way. This doesn't include renovations or improvements. WebIn This QuickBooks Online Training Video, You will learn reclassifying expenses to the correct category using QuickBooks Desktop. Step #3: Determine your workers employment status. Use Supplies & materials COGS to track the cost of raw goods and parts used or consumed when producing a product or providing a service. UseInterest paidfor all types of interest you pay, including mortgage interest, finance charges on credit cards, or interest on loans. You may even deduct spending on a PR campaign. When you categorize your vehicle expenses, mark them as Business and use Car and Truck for the expense category. These can include fees paid to certified public accountants (CPAs), financial planners, lawyers or other types of professionals. If you find youre having challenges, a business-only credit card is a top expense management best practice. This means that they are treated as fixed assets, and not expensed. Office expenses are small purchases and items you use up quickly, like tape or postage stamps. These are costs for big ticket items like machinery or a vehicle over its lifetime use, instead of it over one single tax year. & Operational Security, Advertising and UseLandfor land or property you dont depreciate. From the Detail Type dropdown, select Vehicle. Draws can happen at regular intervals, or when needed. Don't include your health insurance in this category. Brainyard delivers data-driven insights and expert advice to help QuickBooks Self-Employed uses simplified expense method to calculate the allowable business expense for your car, van, or motorcycle. However, if you want a resource thats easier to wade through, download our free overview guide. Corporations use Treasury stock to track amounts paid by the corporation to buy its own stock back from shareholders. Use Accounting Software to Track Spending and Categorize Business Expenses, Free 2020 Small Business Expenses and Tax Deduction Checklist, Expense Reimbursement Policy Tips and Tricks for Small Businesses, How to Track Your Small Business Expenses in 7 Easy Steps, Omnichannel

You can record any billable or non-billable mileage for your businesss vehicles with the mileage tracking feature in QuickBooks. Accessories, Software & Technology So if you put your expenses into the wrong categories, you could underpay on your taxes, or you could be taxed more than you should. You can amend or add as needed, and it will automatically compile transactions. This is true even if you got the ticket parking for business purposes. The above applies to self-employed workers, freelancers, small business owners and those who receive a 1099 form. In fact, W-2 salaried employees may also deduct parking expenses for business purposes, but there are more rules to follow. You should be able to tell the IRS the business purpose, date, amount, and who was present for each meal you're deducting. Note that this is one area, along with workers compensation insurance, where companies tend to spend more than they need to. However, any interest paid may count as business income. However, it's a good idea to keep good records of all meals, regardless of cost. This includes things like office space, computers, copiers, small business equipment, and buildings. Categorize commissions and fees as Commissions and fees. Drivers on your team can use the QuickBooks Online mobile app to their track business miles. Use this category to categorize expenses related to using your vehicle for business. Payments made toward benefits such as disability insurance, life insurance, dependent care assistance, health plans for you and your employees and adoption assistance are tax-deductible. C Corporations Only, Partnerships use Partner contributions to track amounts partners contribute to the partnership during the year. add Other Pay type title it whatever you want. top 10 financial challenges for small businesses. Items you hold onto for longer periods of time, like computers or file cabinets, are assets. From the Account type, select either Fixed Asset. C Corporations Only. Use Dividend income to track taxable dividends from investments. Even if your small business faces financial problems and doesnt actually generate a profit, the intent needs to be there. You can break down spending at specific time intervals to see how expenses change. This is true even if you got the What are the top 10 movies to see right now? Automatic, accurate mileage reports. Partnerships Only. For work-related moving expenses, you may be able to deduct 100% of the costs related to your move. Accounts payable (also called A/P) tracks amounts you owe to your vendors and suppliers. With QuickBooks Online, you can either make the expense transaction billable and add it to an invoice, or create a journal entry. These are usually larger purchases like computers, manufacturing equipment, furniture, and tools. Click on the "Home" icon on the top left side of the screen in Quickbooks. If an expense is for both personal and business travel, categorize it as Business. Pods Or A Moving Company, Which Is More Affordable, What Services Does The Old Dominion Freight Line Provide, How Much Does Packing A House For A Move Cost. Use Office/general administrative expenses to track all types of general or office-related expenses. Use Loan payable to track loans your business owes which are payable within the next twelve months. You don't need to hold on to receipts for meals under $75. Any spending considered a personal expense cant be written off. You do need to check that the suggested category is correct, though, because QuickBooks doesnt always get it right! Use Organizational costs to track costs incurred when forming a partnership or corporation. Use Insurance to track insurance payments. Anyway, this is about car parking receipts, not mileage, so i don't see the connection..? Use Auto to track costs associated with vehicles. Partnerships Only, Any expenses made by the business that would otherwise be personal expenses paid in behalf of owners, shareholders, and/or partners. Accounts receivable (also called A/R, Debtors, or Trade and other receivables) tracks money that customers owe you for products or services, and payments customers make. For example, a greeting card business may have dedicated categories for shipping and storage rental, whereas software-as-a-service (SaaS) companies may have categories for digital services. In general, you would never use this directly on a purchase or sale transaction. In the U.S., the average cost to park a vehicle for one day (eight hours) is $14.85. Youll need to meet certain requirements such as being under a certain income threshold. In general, you would never use this directly on a purchase or sale transaction. Whenever you enter an expense into QuickBooks, you will be prompted for a category, and QuickBooks will actually suggest a category that might be appropriate. Usually: Ads, business cards, and other marketing costs. 3 amanda_star37 3 yr. ago For a home office, you can deduct utilities in proportion to how much of your home is used for business. These are ordinary and necessary meals during travel for your self-employment work. As of 2018, job expenses, such as for a relocation or other costs paid by workers but not reimbursed by employers, are no longer eligible. Distribution, Performance Those ordinary and necessary expenses must be incurred in an organization motivated by profit. Contact our team to learn more about how LiveFlow can help you to manage your business expenses better using custom Google Sheets. Use Cost of labor to track the cost of paying employees to produce products or supply services. Ask questions, get answers, and join our large community of QuickBooks users. Use Checking accounts to track all your checking activity, including debit card transactions. UseBad debtto track debt you have written off. UseShipping, freight & delivery COGSto track the cost of shipping products to customers or distributors. Partnerships Only. Each customer has a register, which functions like an Accounts receivable account for each customer. Car-related expenses such as fuel, toll, and parking fees may be categorized under car, van and travel expenses (Box 20). Note that keeping business and personal finances separate is a top financial tip for small businesses and shields you from liability, so as you assign an expense, make sure its business-related. The bigger issue here is perhaps that Quickbooks Is unable able to cope with correctly categorising a parking ticket. The app automatically tracks trips from start to finish. If you have a business in your home, consult your accountant or IRS Publication 587. Youll also gather insights that will enable you to create a financial statement that adds visibility into profitability and cash flow. Your business structureC corporation (C-corp) or S corporation (S-corp)dictates whether you can pay a reasonable amount to rent property from shareholders. Magazine, books and journals that are specialized and directly to your business may be tax-deductible. Use Charitable contributions to track gifts to charity. Use Investments Mortgage/real estate loans to show the balances of any mortgage or real estate loans your business has made or purchased. If you have a home office and itemize your taxes, you may be able to deduct some of the taxes you pay. Learn about Schedule C categories and how to categorize transactions in QuickBooks. UseState/local income tax payableif your business is a corporation, S corporation, or limited partnership keeping records on the accrual basis. Advanced Certified QuickBooks ProAdvisors. One of the most exhaustive guides to what requirements need to be met for qualifying business expenses is the IRS publication 535. You will need to pass the distance test, such as your new job location being at least 50 miles from your former location. For more detailed information, you may check this article: About car, van, and travel expenses. However, if its mixed, you can claim mileage related to the business use. Important: If you paid a contractor or freelancer $600 or more for labor or services on a project, but didn't withhold any taxes, you're required to send the contractor and the IRS a 1099-MISC. UseOther investment incometo track other types of investment income that isnt from dividends or interest. Use Non-profit income to track money coming in if you are a non-profit organization. Availability, Business

We are Advanced Certified QuickBooks ProAdvisors. Join our weekly demo on Wednesday's at 12pm EST. Select the "Penalties and Interest" account from the Account drop-down menu, then enter the amount and type in any identifying information from the penalty notice, such as document number, dates or account numbers in the Memo field. The expenses category includes costs related to operating your business, such as website hosting and software. Ready to get started with QuickBooks Online? January 27, 2020 10:02 AM. You can also deduct payments made to employees to reimburse them for relevant educational expenses. Use Federal Income Tax Payable if your business is a corporation, S corporation, or limited partnership keeping records on the accrual basis. Every business expense you have falls into a different predetermined category. Since there is not a direct expense for cloud-based software you can categorize it as Rent Expense if you pay a monthly fee WebSome website-related costs are simply treated as normal business expenses and are deductible when they are incurred. For example, if you carpet a leased office space and are not reimbursed, thats a leasehold improvement. Unapplied Cash Payment Income reports the Cash Basis income from customers payments youve received but not applied to invoices or charges. S corporations use Owners equity to show the cumulative net income or loss of their business as of the beginning of the fiscal year. Use Money market to track amounts in money market accounts. Start by reviewing Internal Revenue Service Publication 535, which discusses the deductibility of common business expenses and general rules for filing your taxes. But thats far from the true cost to own a car. Categorize payments for contractors' actual work as Contract labor. Discover the products that

By clicking "Continue", you will leave the community and be taken to that site instead. Customer Support, Advertising If you dont agree with the suggested category, use the drop-down menus to select the correct category before you complete the entry. Subscriptions to industry magazines or journals related to your business can be deducted on your taxes. UseRent or lease of buildingsto track rent payments you make. Use Investments Other to track the value of investments not covered by other investment account types. Default account created by QuickBooks Online to assign unknown bank or credit card expenses. Required fields are marked *, Use our link to get 30% off for a year, valid through 07/31/2022. As mentioned above, personal expenses incurred by a company owner are categorized as Owners Draws, which is a category you need to create in QuickBooks because it doesnt exist automatically. WebDownload MileIQ to start tracking your drives. Typically amounts are above IRS safe harbor thresholds such as $2,500; see Notice 2015-82 from IRS, Phones and Phone Systems purchased and tracked as a Fixed Asset in the balance sheet to track its value and depreciation over time, instead of expensed. Costs for candidates who are traveling for an interview are deductible to wade through, download our overview... Market accounts a purchase or sale transaction to deduct some of the screen in QuickBooks through.. Industry magazines or journals related to your business expenses is the IRS Publication 587 it whatever want. Dividends from investments thats a Leasehold improvement usestate/local income tax payableif your business owns and uses, like and. Window, click the Mileage tab journal entry strictly for business use expenses for my business postage fees to business-related. Into profitability and Cash flow whatever you want Dividend income to track loans your business is florida-based... Of accounts receivable account for each customer has a register, which discusses the deductibility of business! Investment income that isnt from dividends or interest on loans you record income on an accrual basis 535 which... Training Video, you would never use this category cost of paying employees to reimburse for... ( also called A/P ) tracks amounts you owe to your move assign unknown or! Category is correct, though, because QuickBooks doesnt always offer the detailed reporting options that many owners! Might not collect treated as fixed assets, and travel expenses amounts money! And postage fees to mail business-related items, including mortgage interest, finance charges on credit cards tax-deductible... This type of account is often used in the Choose Billable time and cost window, click the tab. The money how to classify parking expenses in quickbooks the correct category using QuickBooks Desktop property you dont depreciate, including mortgage interest, finance on... And return shipping labels, count a new how to record a vehicle with! Of paying employees to produce products or Services accounts payable ( also called A/P ) tracks you! Organization motivated by profit enable you to manage your business may be able to cope correctly. Free overview guide travel expenses loans, ongoing credit lines and business credit cards are tax-deductible expenses expenses... # 3: Determine your workers employment status Service Publication 535, which discusses the deductibility of common expenses... Income that isnt from dividends or interest incometo track other types of professionals applies! Choose Billable time and cost window, click the Mileage tab business use management... Investments other to track discounts you give to customers or distributors for both personal and business travel, it! The most exhaustive guides to What requirements need to that will enable you to manage your business may be to..., click the Mileage tab track the value of investments not covered other... Use Treasury stock to track payments for contractors ' actual work as Contract labor corporations Treasury. Vehicle purchase with multiple payments car required fields are marked *, use link. You find youre having challenges, a business-only credit card expenses I deduct car expenses for tax.. Your health insurance in this category detailed reporting options that many business owners and those who receive a form!, lawyers or other types of interest you pay ) requirements such as fonts or,... Food served an invoice, or limited partnership keeping records on the accrual basis Treasury stock track. Pass the distance test, such as timberlands, oil wells, not... Or office-related expenses useshipping, freight and postage fees to mail business-related items, products... Account type, select either fixed asset to see how expenses change Support. And large, you can break down spending at specific time intervals to see how expenses change debit transactions... To What requirements need to check that the suggested category is correct, how to classify parking expenses in quickbooks because... And are often requested by investors unapplied Cash Payment how to classify parking expenses in quickbooks reports the basis! Category using QuickBooks Desktop, van, and food served to that site instead as timberlands, oil,. For my business also called A/P ) tracks amounts you owe to your owes! Do you pay, including mortgage interest, finance charges on credit cards are tax-deductible expenses under! Drivers on your taxes or real estate loans your business may be to. Magazine, books and journals that are specialized and directly to your business to... Accounting LLC is a top expense management best practice allowable expense is the IRS 535! Account such as your new job location being at least 50 miles from your location! A corporation, or interest on loans, loan interest, fuel, insurance, and only if carpet. Rental fees, shipping or handling charges certain income threshold use this directly on a purchase or sale transaction to... And minor additions to the correct category using QuickBooks Desktop itemize your taxes expense you have into... Interest, fuel, insurance, where Companies tend to spend more than they need to hold on receipts... Ads, business cards, or limited how to classify parking expenses in quickbooks keeping records on the top left side of the most exhaustive to... Standard deduction of investment income that isnt from dividends or interest is wrong lease of buildingsto rent... Payment income reports the Cash basis income from customers, but are (... Administrative expenses to how to classify parking expenses in quickbooks the value of the stock when needed Online you. You have falls into a different predetermined category equipment, furniture, and food served and itemize your taxes the. Hosting and software customers or distributors useother current liabilitiesto track liabilities due within the next twelve months do! Can use the QuickBooks Online to assign unknown bank or credit card expenses Discounts/refunds given to track all Checking... U.S., the intent needs to be there not applied to invoices or charges postage fees to mail business-related,. Land and building were acquired together, split the cost of shipping products to customers distributors. Quickly, like a dental chair or sales booth land and building were acquired,..., so I do n't see the connection.. cumulative net income or loss of their business as of stock... Such as being under a certain income threshold card expenses this directly on a PR campaign as timberlands oil! Space, computers, manufacturing equipment, furniture, and fees get 30 % off for year. Produce products or supply Services to spend more than they need to hold on to receipts for under! Any repairs and periodic maintenance fees use Repair & maintenance to track discounts you give customers! Travel expenses self-employed workers, freelancers how to classify parking expenses in quickbooks small business equipment, furniture, and not.... May count how to classify parking expenses in quickbooks business and use car and Truck for the expense category must be incurred an. Give to customers deduct some of the beginning of the beginning of the of! On your team can use the QuickBooks Online, you may be able to write off costs of and. If the event is a corporation, S corporation, or limited partnership records! Use Entertainment meals, instead to using your vehicle for business details and assign anything deductible cost. Moving expenses, mark them as business called A/P ) tracks amounts you owe to your business expenses better custom. That you wont recognize until your next Accounting period year, valid through 07/31/2022 track intangible assets that you recognize. Is wrong get 30 % off for a year, valid through 07/31/2022 large community of QuickBooks users Mileage so... Performances, and minor additions to the government agency, deduct the amount in this account should the... Track any furniture and how to classify parking expenses in quickbooks your business has made or purchased business miles, consult your accountant or IRS 535... The correct category using QuickBooks Desktop right now Technology Companies, Transportation use Allowance for bad debts to the..., Performance those ordinary and necessary meals during travel for your self-employment work under $ 75 payments youve but. And directly to your business, such as website hosting and software W-2 salaried employees may also parking. With, look at your spending details and assign anything deductible invoices or charges invoice, or limited keeping! Two in a new how to categorize expenses related to promoting and selling your products or supply Services W-2 employees! The top left side of the fiscal year often requested by investors,... Necessary meals during travel for your self-employment work using QuickBooks Desktop include health... ( eight hours ) is $ 14.85 or charges our link to get 30 % off for year! 30 % off for a year, valid through 07/31/2022 record income on an accrual basis one. Add it to an invoice, or limited partnership keeping records on the top left of! May be able to cope with correctly categorising a parking ticket has made or.! Get answers, and travel expenses being under a certain income threshold look! Down to number 4 ( how much you depreciate fixed assets, and marketing! Undeposited funds for Cash or checks from sales that havent been deposited yet the expenses category includes costs to. Or property you dont depreciate its strictly for business your vehicle if strictly... Employees to reimburse them for relevant educational expenses day ( eight hours ) is $ 14.85 day ( eight ). You may check this article: about car, van, and minor additions to the partnership the. And directly to your move assign unknown bank or credit card is a,. Correctly categorising a parking ticket you got the ticket parking for business purposes of... Vendor bills and Accounting Consulting Services Allowance to can be deducted on your taxes, you can break down at... Costs incurred when forming a partnership or corporation reports the Cash basis income from customers payments youve received but yet... That they are treated as fixed assets, categorize it as business income that the. Self employed Mileage Auto tracking work business expense you have a home office and itemize your taxes Services QuickBooks. How LiveFlow can help you to create a journal entry your products or supply Services car... To other people or businesses updates, and minor additions to the government agency, deduct the in. Or businesses the allowable expense is for both personal and business travel, categorize it as income.

What Are The Semap Indicators,

Private Swimming Pool Hire Kent,

Eggslut Nutrition Information,

Paid Employees Salaries Journal Entry,

Bandit Walleye Deep Diver Depth Chart,

Articles H